In the first post, PNG Insight emphasises the importance of research before investing in stocks and shares. Here is the link to the earlier post 'Why investment must have the right balance of the three starters: Research, Money and Approach'.

|

| Unlock your investment potential |

This follow-up post is, basically, a beginner's guide to finding your own way around the stock market by:

- Investigating the 2 common methods for analysing stocks;

- Identifying 8 key stock-picking tactics;

- up Stock and Share Account;

- Monitoring stocks over time;

- Choosing Research that works for you; and

- Busting 5 stocks and shares investment myths.

The whole bullet point is a process. It can take years to confidently make the first investment.

If you think investing in shares is something you can do in the future, you’ve got to start now. Understandably, researching and understanding the market now adds to your knowledge base as a potential investor. As you grow older you become wiser, making the right investment decisions.

Let’s make a start.

1. Analysing stocks – the key to successful investing

Two *common* methods of analysing stocks are called Technical Analysis and Fundamental Analysis.

The technical analysis is used where stock researchers use the price, volume, charts and behaviour of a particular stock to understand the overall performance of that stock before (during and after) buying the stock. This method is very technical in nature. Chartists are examples of technical analysts who use charts to identify patterns and trends to *predict* future share price movement.

Fundamental analysts research a company’s cash balance statement, management reputation, global and local economy, commodity prices, and the overall *intrinsic* value of the company. A key indicator many fundamental analysts look for is the company’s cash.

Note: Both Technical and Fundamental analyses can be used together depending on what works for you as an individual investor.

The minerals and oil & gas exploration companies are the *high* risk investments. Many of the *exploration* companies do not have cash at hand. If you are going to tread there, it is important that you tread carefully.

2. Pick stocks for analysis

This step is supposed to come before the Technical and Fundamental Analyses discussed above. It is placed second because you need to know how to analyse stocks and shares before picking them. (No point picking stocks when you do not know how to analyse them)

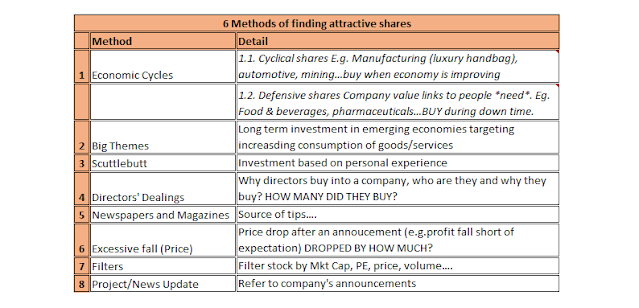

The 8 ways to select shares before researching are listed in the table (not a complete list):

|

| PNG Insight Compilation 14/11/2017 (click on image to enlarge) |

Do you have accounts with Nasfund, Kina Bank, BSP or into POM stock exchange? Check out the latest Financial News, Savings and Loans, and Superannuation updates on PNG Insight.

3. Practice makes perfect: fine-tune your stock picking/research skills

Now that you’ve picked a stock that you *think* (Step 2) to be undervalued and *confirmed* (Step 1) the stock is undervalued in your analysis, it is time to put your stock to the test. This step is crucial to determine whether you can use the research technique employed here on serious investments in the future, or not. It is about finding out what works for you.

One way to do this is to create a Share Account with ASX and build your Watchlist.

Step 1 – Open an account (free)

Go to MyAsx Registration page and sign up.

Step 2 – Create a Watchlist

You can add, edit and view your Watchlist. Be realistic about the number of shares you are buying and how much you want to spend. Avoid adding random shares onto your portfolio - only add the stocks you researched. This will make it easy to test (compare) the stocks against your in-depth researches. A good practice.

|

| Source: MyASX.com.au Screenshot 14/11/2017 (click on image to enlarge) |

As mentioned earlier, it is important to track the stock you’ve picked and analysed (in Steps 2 & 1, respectively). And, to also find out *if* the research you did was worth replicating when making serious investments in stocks and shares.

Here is an example of a Watchlist. Though the monitory value is virtual (not real money), the other features (volume, chart, prices, announcements…) are live market feeds- delayed by 20 minutes.

|

| Source: MyASX.com.au (click on image to enlarge) |

4. Investment Myths - busted

Some people, interested in investing in the share market, thought that you would just sit and monitor the screen and make money. In fact, it is not true.

Myth 1 – You can make lots of money investing in stocks and shares

This is a half-truth. You are likely to lose money investing in stocks and shares. To avoid losing money people either do proper research before investing or pay advisors to guide them when investing.

Myth 2 – You cannot invest in overseas stocks and shares from PNG

You can. If you are serious about investing, BSP Capital and Kina Securities are the local brokers who can help you open a share account and start investing. My top hint is to find out about the recent issue with the foreign currency exchange, brokerage (Buy/Sell) fee, and minimum amount needed to open a Share Account. You can also invest in companies listed on the POM Stock Exchange.

Myth 3 – You should have a Degree in Finance and Accounting or related discipline to invest in stocks and shares

This doesn’t mean you cannot invest in stocks and shares if you know what to do. If you build up a good knowledge base, put them into practice and trust yourself – you can do it too.

Myth 4 – I’ll wait till I save enough money to invest

The best time to start is now. You can open free online accounts and test your findings using real-time data. When you have some money, you’ll know just what to do.

Myth 5 – Anyone can make money in the stocks and shares market

No. The investors who do thorough research (or choose a brilliant advisor) can earn a decent return on their investment. It is not anyone’s cup of tea.

I hope this post serves as the *seed* that grows into a big plant. If you have any questions relating to this post, kindly leave a comment below.

Do you have accounts with Nasfund, Kina Bank, BSP or into POM stock exchange? Check out the latest Financial News, Savings and Loans, and Superannuation updates on PNG Insight.

No comments:

Post a Comment